With the popularity of consumer-directed health plans on the rise, employers should take note of the various advantages and disadvantages of using an HDHP in their health care strategy.

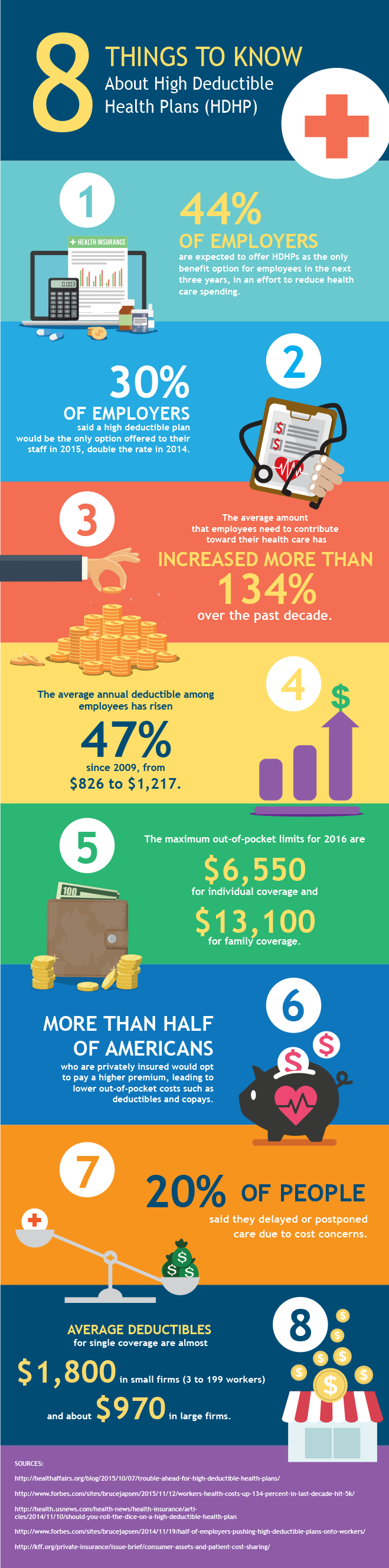

High deductible health plans, aka consumer-directed plans, require plan holders to spend a certain amount of money on health care before coverage begins – must meet deductible amount before doctor visits, etc. are fully covered. They are characterized by higher deductibles with lower monthly premiums. The appeal is the low monthly premium, and that is worth the high deductible for many. The concern with HDHPs is more of the cost is shifted onto employees, rather than employers (aka higher cost sharing).

Deductibles are generally thought to curtail the use of nonessential health services. Meaning, if people have to pay upfront for services, then they are less likely to seek medical assistance for nonessential services. Some opponents anticipate that individuals may put off necessary medical treatment or preventive care in order to save money. High deductible plans can be risky if an unexpected medical cost comes up or you have a chronic condition with high recurring costs, requiring you to pay your entire deductible out-of-pocket, which could be in the thousands of dollars depending on your plan.

HDHPs are very often paired with a health savings account, which allows employees to save pretax dollars for out-of-pocket medical expenses like copays and deductibles. Sometimes employers contribute to HSAs as well.

Expert tip: Study your plan design, whether it comes from your employer or from a private exchange, and make sure you know how you can use your plan. Decide if an HDHP is right for you and your employees.