What does PEO stand for?

The acronym PEO stands for “Professional Employer Organization.”

What is a PEO?

A Professional Employer Organization, or PEO, is a business model that helps small to mid-sized businesses manage the everyday HR needs that smaller businesses struggle to handle alone, like paying employees, filing payroll taxes, providing health insurance (and other benefits), getting workers compensation coverage, writing employee policies, managing employee issues, and more.

A PEO manages the entirety of the employee life cycle under one roof – consolidating your vendor relationships and, ultimately, freeing you up for everything else that matters to your business. The “employee lifecycle” is a practical way of looking at employment and depicts the critical points where employers can enhance the employee experience. By mastering these essential touch points, your business will minimize risk and maximize your return on wage dollars spent.

1. Recruiting

Attract the employees who will help drive your business and increase profits.

2. Hiring

Effective hiring processes help employees get up to speed and become productive quickly.

3. Compensation

Determine competitive wages so you can attract better employees.

4. Benefits

A comprehensive employee benefits package that will help you retain and attract high quality employees.

5. Payroll & Tax Administration

You receive employee productivity in return for your investment of wages, but after that it is mainly a highly regulated and administrative function that has to be done properly to avoid penalties and fines.

6. Performance Management

Gauge the performance of your employees and your company in order to maintain expectations and improve overall employee productivity.

7. Worker’s Compensation & Liability Management

Mitigate risk of fines, lawsuits, and poor return on wage dollars spent, by reducing the likelihood of workplace injuries and employee conflicts.

8. Compliance

Employment is one of the most regulated and risky aspects of running a business, which is why you must have a plan that protects your company from fines and litigation.

9. Documentation Management

High quality record keeping is essential because it is:

a. required by law,

b. protects companies from frivolous litigation, and

c. helps drive employee productivity.

10. Employee Separation

Separation can be the riskiest point in the employment relationship. It has a lot of regulation and may impact your customers, revenue, and other employees.

These 10 critical points of the employee lifecycle are often neglected because they are not perceived as value-added tasks. But by improving just some of these critical points, companies experience greater productivity, reduced risk, attract better employees, retain their employees, and more. A PEO helps you at each of these steps. They focus on the regulatory preparation/paperwork and day-to-day employee administration so you can focus on HR strategies that impact your profitability.

See how a PEO works here.

How does it work?

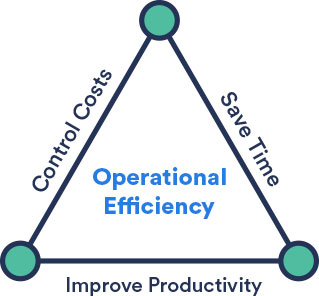

A PEO standardizes and harmonizes critical employee management processes.

- We standardize – We create uniformity in payroll, benefits admin, and HR processes that help you more consistently meet cost and business objectives.

- We harmonize – We handle many of these specific processes and make sure they all fit together harmoniously.

When you establish this level of consistency, a series of things can happen:

- Processes become more consistent, and therefore more reliable.

- With fewer inconsistencies, you can mitigate the risk of unexpected costs, lower the maintenance costs of employee management processes, and increase business agility.

- With better systems and practices in place, you can reduce the likelihood of error and miscommunication (whether between technology systems or departments).

- And ultimately, you get more control over business operations.

What are the advantages of working with a PEO?

Because a PEO can standardize the predictable and manage the unexpected, businesses working with a PEO experience more growth, lower turnover, and are less likely to go out of business.

– NAPEO

How can a PEO do all of that? Through a co-employment relationship.

In order for a client to get the full benefit of a PEO, they have to enter into a co-employment relationship. A co-employment relationship establishes a partnership between the client company, the PEO, and the client’s employees, which authorizes the PEO to pay the client’s employees and file payroll taxes on behalf of the client because the PEO is considered the “employer of record.” A PEO does not direct employees’ day-to-day activities or hire or fire anyone. The client maintains complete control of their employees under a co-employment relationship.

Want to know more?

XcelHR provides PEO services to more than 600 businesses and 8,000 worksite employees. Our HR and benefits experts can help answer your questions. If you are interested in learning more, contact us.