Selecting the right health insurance plan for your business can be difficult. The choices you make have real and measurable impacts on your business’s success. Unfortunately, the health insurance market does not make it easy for you to make the best decision. Furthermore, the group health plan landscape is continually shifting, the terminology is difficult to understand, and the subject matter can be dry and boring. These obstacles make it difficult to stay updated and shop for the best health plan option.

This article helps you understand the intricacies of health plan evaluation. You will learn the basic terms and types of insurance plans available. Once open enrollment comes around, this guide will help you confidently select the best health insurance for your business.

What is a group insurance plan?

A group health insurance plan is a health policy that you as the employer can purchase. You select the plans you want to make available to your eligible employees. Most group health insurance plans allow employees to add their eligible family members as dependents

Under a group health insurance structure the next step is to determine the portion of the premium you are covering. The remaining figure is what the employee is responsible for. Splitting the cost in this manner is regularly referred to as Cost Sharing.

What are the types of group health insurance?

Generally speaking, there are 4 common types of group health plans available to employers:

- HMO- Health Maintenance Organization

- PPO- Preferred Provider Organization

- EPO- Exclusive Provider Organization

- POS- Point-of-Service plan

The main differentiators between these plans are:

- Freedom & Choice

- Cost

- Regional Restriction

Freedom & Choice

When looking at health plans, determine when and how your employees can receive care. Do they need a primary care physician (PCP)? If they want to see a medical specialist, do they need to receive a referral from their primary care provider? Can they can receive care out-of-network? Understanding what’s important to your employees will help you answer these questions and determine the type of plan you need.

Cost

Each type of plan can generally be described as a medium or high cost plan. Generally as freedom and choice increase, so does cost. A plans cost will determined by 5 factors.

- Premium- the monthly cost to be enrolled in the plan

- Deductible- a specified dollar amount the insured must pay out for covered expenses before an insurance company pays its specifies portion

- Coinsurance- is your share of the costs of a covered health care service after the deductible has been met

- Copay- is a specific covered amount that your health insurance plan requires you to pay to receive a particular medical service or supply

- Out-of-Pocket Maximum- The most you have to pay for covered services in a plan year. After you spend this amount on deductibles, copayments, and coinsurance, your health plan pays 100% of the costs of covered benefits for the remainder of the plan year.

If you want to learn more, check out our in-depth article on how each factor works and how they interact with each other.

Important factors to consider when selecting your plan

Regional Restriction

Something that doesn’t get talked about much is how the location of your employees can restrict the type of coverage for which your business is eligible. Employers whose employees all live in the same state have access to all 4 types of healthcare plans. Unfortunately, if your employees live across different states, your options become more limited and costly. Generally, the two least expensive plan types are the HMO and EPO. These are often not available to businesses that employ individuals across state lines.

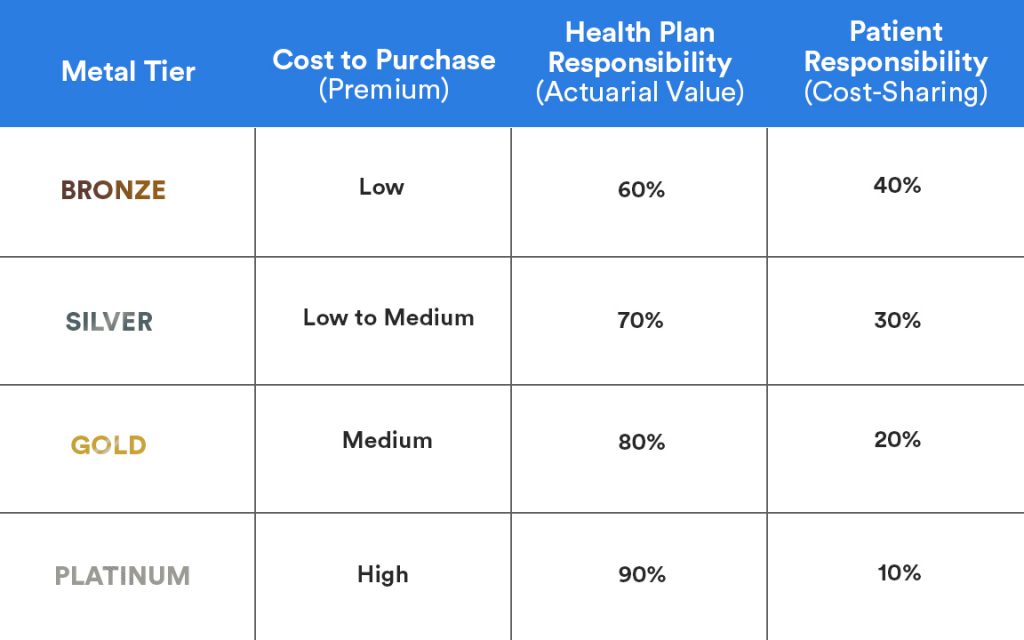

Metal Level

A health plan is valued based on its tier of cost shearing or metal level. Which describes the respective percentage of cost that the employee and the insurance company each cover. The metal levels ascend from Bronze to Platinum. The Bronze level has the lowest monthly premium, but the highest employee cost for care. The Platinum level has the highest monthly premium, but the lowest employee cost for care. Therefore, as the metal level increases, so does the purchase cost (premium).

Evaluate your business needs

Now that you are aware of health plan types and cost sharing structures, it’s time to ask yourself a few questions about your business needs:

Q1 – Do your employees perform repetitive strenuous tasks or work in hazardous environments?

The higher the risk of injury on the job, the higher your insurance cost will be.

Q2 – Is the labor market in your industry competitive?

If you’re having difficulty attracting qualified candidates or retaining current employees, you might consider providing a more robust benefits package. We have a great article on how to use your benefits strategically and inspire employee loyalty.

Q3 – what are the demographics of your company?

Insurance companies factor in group size, location, average age, and gender when calculating premium cost.

Selecting a group health plan is not easy, but now you have a great foundation and understanding of the factors at play. If you need further assistance, XcelHR is here to help you. We will guide you through the process and help you make the best decision for you and your employees. Working with a PEO like XcelHR can save you money on your benefits and give you access to brokers with over 30 years of experience. It never hurts to have someone with experience on your side. See how XcelHR can help you.