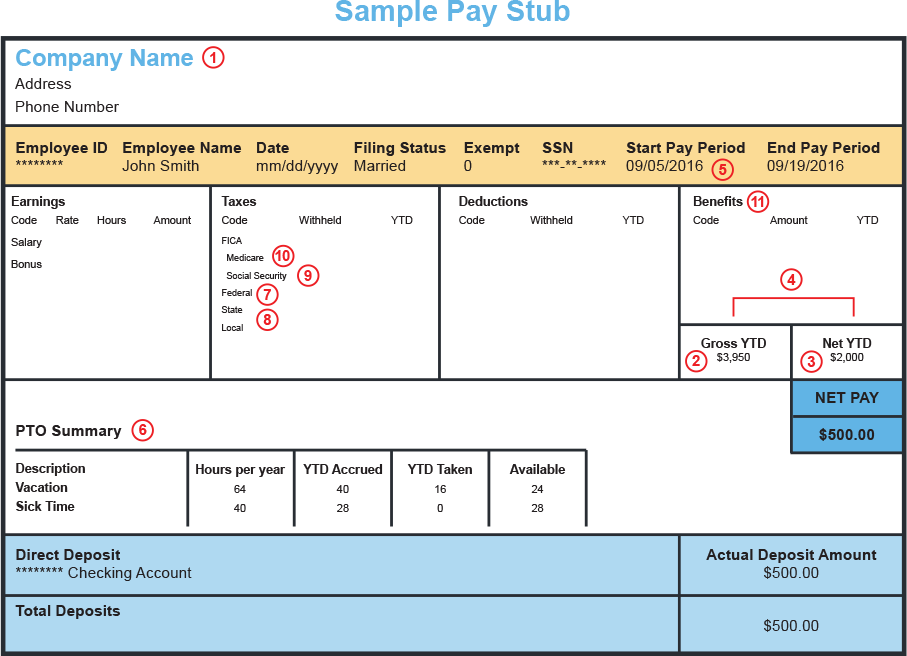

Do you ever wonder how much your paycheck will be after taxes? Do you know what those taxes and other deductions are and why? Understanding the items on your paycheck are important for financial planning and checking for errors. Get rid of the mystery and get to know what’s on your paycheck with our guide below. The sample pay stub includes items typically listed on a regular paycheck. Use the corresponding numbers below to learn more about what’s on your paycheck.

- Basic Information: Employer information (name and address) and employee information (employee ID number, job title, Social Security Number, department, date)

- Gross Pay: The amount of money you make before taxes. You can divide the gross pay by the number of pay periods per year, to see the gross amount per check.

- Net Pay: The amount of money you have left over after all taxes and deductions are taken out of gross pay (aka take home pay).

- Year-to-Date (YTD) Earnings: You should also see earnings for the entire year, up to the date of your most current check.

- Pay Period: You should see earnings and hours worked for the current pay period. Generally, pay periods are weekly, bi-weekly, semi-monthly, or monthly.

- Vacation and Sick Leave: You may see the number of paid time off (PTO) hours you’ve accrued and taken throughout the year on your paycheck.

Deductions

Tax Withholdings

- Federal Taxes: Federal income taxes, commonly abbreviated to FT (federal tax) or FWT (federal tax withheld). There are seven federal income tax brackets and new rates. For the 2018 tax year, the tax rates are 10, 12, 22, 24, 32, 35, and 37 percent of your income. For 2017 rates, click here. Determining which rate applies to you is dependent on other exemptions, including whether you are filing as single, married, or head of household. When you first start a new job, you are required to fill out a W-4 form that determines how much the federal government will withhold from each paycheck. Check out the IRS withholding calculator for help. As a result of what you put on your W-4, you may see your maritalstatus, allowances and exemptions, and any other tax withholding information on your paycheck.

- State and Local Taxes: All states with the exception of Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming, pay state taxes. Some localities (usually a city) might have an additional local income tax i.e. if you live in Maryland but you work in Washington, D.C.

- Social Security: This is one half of FICA (Federal Insurance Contribution Act) taxes. You pay 6.2 percent of the first $118,500 of your salary and your employer matches that amount, also paying 6.2 percent (for a total of 12.4 percent). This money goes towards the Social Security program, which helps retirees, as well as people who are unemployed or disabled.

- Medicare: This is the other half of FICA taxes. You pay 1.45 percent of all of your income towards Medicare, the federal system that helps the elderly with medical expenses. Your employer matches your amount, also paying 1.45 percent of all of your income towards Medicare (for a total of 2.9 percent).

Benefits

401k: If you contribute to a retirement savings plan, you may have the contribution automatically deducted from your paycheck, pre-tax.

Health Insurance: If you have employer-sponsored health insurance(health/dental/vision), and must contribute towards the premium expenses – then you may have that deducted automatically from your paycheck.

Flexible Spending Accounts (FSA): Flexible spending accounts let you set aside money for medical costs or child care costs, pre-tax.

Life Insurance: Many employers may pay for a limited amount of life insurance coverage (which provides money to a beneficiary to cover expenses in the event of an employee’s death). Employees may also have money deducted from each paycheck if they want to increase their coverage.

Disability Insurance: If you have an accident and are disabled or ill for an extended period of time, disability insurance can help make up the lost income. Workers compensation is usually the basic amount of coverage provided by an employer (and is required by law). Coverage varies by location, need, and employer.

Childcare Assistance: If your company offers onsite childcare, that cost may be automatically deducted from your paycheck. (If you owe child support payments, some states may automatically deduct this amount from your paycheck.)

Why is this important?

You want to make sure you’ve chosen the correct exemptions and allowances so you don’t have more money being withheld from your paycheck than is needed. It’s also good to check the accuracy of your pay and other benefits so you can rectify errors immediately. The longer a payroll mistake goes unfixed, the more difficult it becomes to fix later.